Introduction

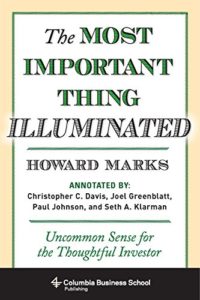

The Most Important Thing Illuminated is a book about value investing. This book is a statement of the author’s investment philosophy. I chose this book to learn more about value investing and maybe to gain different perspectives.

Author

Howard Marks is the co-founder and co-chairman of Oaktree Capital Management. He started his career as an equity research analyst in Citicorp. After that, he joined TCW Group.

There are five annotators in this book and they are Bruce Greenwald, Christopher Davis, Joel Greenblatt, Paul Johnson and Seth Klarman. They all have extensive experience in the field of investment.

Content

The Most Important Thing Illuminated contains 21 chapters, a foreword and an introduction.

Each chapter begins with the phrase “The Most Important Thing Is …” followed by the chapter title. The chapters are 1) Second-Level Thinking, 2) Understanding Market Efficiency (and Its Limitations), 3) Value, 4) The Relationship Between Price and Value, 5) Understanding Risk, 6) Recognizing Risk, 7) Controlling Risk, 8) Being Attentive to Cycles, 9) Awareness of the Pendulum, 10) Combating Negative Influences, 11) Contrarianism, 12) Finding Bargains, 13) Patient Opportunism, 14) Knowing What You Don’t Know, 15) Having a Sense for Where We Stand, 16) Appreciating the Role of Luck, 17) Investing Defensively, 18) Avoiding Pitfalls, 19) Adding Value, 20) Reasonable Expectations, and 21) Pulling It All Together.

Chapter 21 is the conclusion and summary of this book.

The annotators provide their own views on the subject matter. The author also adds his own commentary throughout the text.

Review

The Most Important Thing Illuminated does not offer much on financial analysis or investment theory but more on thought process. It is about how to think and how to deal with psychological influences that interfere with investment thinking and about the mistakes others make in their thinking. The discipline that is most important in investing is not accounting or economics, but psychology because biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.

Investing consists of exactly one thing: dealing with the future. What does successful investing require? Thoughtful attention to many separate aspects at the same time. To achieve superior investment results, an investor has to hold nonconsensus views regarding value, and they have to be accurate. In fact, an accurate estimate of intrinsic value is the indispensable starting point. Our insight into value has to be superior by learning things others don’t, seeing things differently or doing a better job of analysing them but ideally all three.

This book mainly discusses on risk. The author’s definition of risk is uncertainty about which outcome will occur and the possibility of loss when the unfavourable ones do. Eventually, it’s largely a matter of opinion. Two main risks in investing are risk of losing money and the risk of missing opportunity. Thus, it is up to us to strike a balance between both.

Most investors’ results are determined more by how many losers they have, and how bad they are, than by the greatness of their winners. Furthermore, being correct is not the same with being proved correct right away when we are investing. According to the author, the real penalty for investing is making losing investments. Thus, avoid losses is more important that striving for great investment successes. The goal of every investor should be asymmetry – better performance on the upside than on the downside relative to what investing style alone would produce

Great investing requires both generating returns and controlling risk. Success of investment should not be highly dependent on normal outcomes prevailing, instead, we must allow for outliers. This can be achieved by awareness, flexibility, adaptability and a mindset that is focused on taking cues from the environment

The author does not believe in technical analysis. He believes it’s the job of contrarians to catch falling knives, hopefully with care and skill. It is just not realistic to expect to buy at the rock bottom.

The author gives the following advice to the readers: investing scared, requiring good value and a substantial margin for error, and being conscious of what you don’t know and can’t control are the hallmarks of the best investors.

The main lesson that I learned from this book is about how to control risk. It is impossible to eliminate risk in investing, but we can try to reduce it. Although there is not much investing technique discussed, I find this book to be very helpful as technique can be individualized but the general risk control mechanism is universal.

Quotes

- Good times teach only bad lessons: that investing is easy, that you know its secrets, and that you needn’t worry about risk. The most valuable lessons are learned in tough times.

- The quest in value investing is for cheapness.

- No strategy can produce high rates of return without risk.

- You must do things not just because they’re the opposite of what the crowd is doing, but because you know why the crowd is wrong.

- When there’s nothing particularly clever to do, the potential pitfall lies in insisting on being clever.

Rating

Interested in The Most Important Thing Illuminated?

You may get the book from Kinokuniya Malaysia through the link below*.

*Disclosure: The above link is Involve Asia affiliate link. Thus, I may earn a small commission when you purchase the book through this link.

No Comments